After the Republican convention, I addressed Paul Ryan’s claims about the use of stimulus funds. In this post, I want to address many Democrats’ calls for “equal pay for equal work” for women in their convention speeches. In touting Obama’s accomplishments, Dems referred to the Lilly Ledbetter Fair Pay Act of 2009, Obama’s first major legislative feat.

First, let’s take a look at the latest statistics regarding the gender pay gap. According to a December 2011 report issued by the Bureau of Labor Statistics, women made up 47.2% of all employed workers in the US in 2010. They represented 54.9% of those employed in business and financial operations occupations, 64.2% of those employed in community and social services occupations, 73.8% of those employed in education and library occupations, and 74.3% of those employed in health care practitioner and technical occupations.

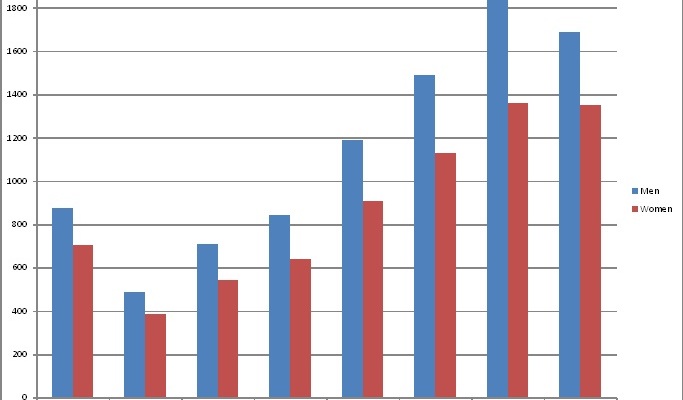

The median weekly salary for men over 25 in 2010 was $874, compared with $704 for women. The median male was earning 24% more than the median female. Below is a graph of median weekly salaries for men and women over 25 by educational attainment. At every level of education, the median male earns more than the median female. However, the wage differential is greatest at higher levels of education, particularly those with professional degrees. The median male whose highest level of education is a bachelor’s degree earned over 30% more than the median female with a bachelor’s degree, while the median male with a professional degree earned 38% more than the median female with a professional degree.

Yet the Lilly Ledbetter Act, though passed in the spirit of reducing the gender pay gap, does not directly address discrimination based on sex. Lilly Ledbetter, who also gave a speech at the Democratic convention, was an employee of Goodyear Tire & Rubber Company. After she retired from Goodyear in 1998, she sued the company for gender discrimination, citing the fact that she was earning significantly less than her male equivalents at the company. She claimed that she was denied the same pay raises as her male peers. The basis of her case was that her current retirement income was reduced because of previous acts of discrimination.

The district court ruled in her favor and awarded her back pay and damages, but an appellate court overturned this ruling. Goodyear made the case to the appellate court that her complaint of alleged discrimination was made outside the 180-day period specified by the Civil Rights Act of 1964. Ledbetter took her case to the Supreme Court, arguing that the pay discrimination was not a single event but a series of actions, and the Court should use a different rule for establishing when the 180-day clock starts. In May 2007, the Supreme Court ruled 5-4 in favor of Goodyear. Justice Alito in the majority opinion pointed to several instances where similar claims had been rejected because they were filed too late.

The next month, House Democrats put forth a bill which specified that discrimination occurs not just when the discriminatory choice is made by the employer, but also every time the individual is affected by the discriminatory decision, that is, every time the individual receives a paycheck. Republicans opposed the bill on the grounds that it would invite frivolous lawsuits against employers. The bill was re-introduced in the next legislative session, when Democrats had majorities in both chambers, and signed by President Obama on January 29, 2009. The Lilly Ledbetter Fair Pay Act legislatively overturned the Supreme Court’s 2007 decision, amending Title VII of the Civil Rights Act so that the 180-day time period starts each time the employee receives a paycheck which is affected by a discriminatory decision, instead of starting when the discriminatory pay decision was made.

A similar bill, the Paycheck Fairness Act, passed the House and stalled in the Senate in 2009, which would require greater transparency in pay decisions and make it easier for women to dispute pay which they believe is reduced as a result of gender discrimination, particularly by removing the time limit to file a complaint. The bill was re-introduced in both houses in April 2011 but has not passed either house. The bill has been criticized by Republicans and some Democrats for placing too great a burden on businesses and for making it more difficult for businesses to defend themselves.

The Lilly Ledbetter Act, in short, allowed women greater flexibility in filing complaints against employers for gender discrimination. It did not directly address the issue of equal pay, nor did it provide a method for identifying how pay decisions are made or whether they were discriminatory. Therefore, it seems misleading for Democrats to tout the legislation as achieving “equal pay for equal work” as many did at the convention. What is more important, though, is that the bill was passed with the goal of one day eliminating such discriminatory decisions and reaching full equality of pay. It is also clear that the Democratic party has made efforts towards this end, such as the more recent Paycheck Fairness Act, though it has not passed Congress.

Feel free to post with any comments or corrections!

– Anthony