I’m back to write about some issues that I’ve come across in the past few months – some old, some new. Now that I have finished my thesis and finished the final classes of my undergraduate career, I’ve got the time and drive to revive this blog and continue to post about new public policy interests.

First, a note about my senior thesis on Social Security reform, entitled “When I’m Sixty-Seven: Public Opinion on Social Security Reform and a Proposal to Restore Long-Run Solvency”. The first part included an analysis of public opinion, which explained that, based on a web-based survey with 3,300 responses which I administered in January-February of this year, the three most popular ways of reforming Social Security are (1) increasing the maximum taxable amount subject to payroll taxes, (2) reducing benefits for high-earners, and (3) personal retirement accounts (or privatization).

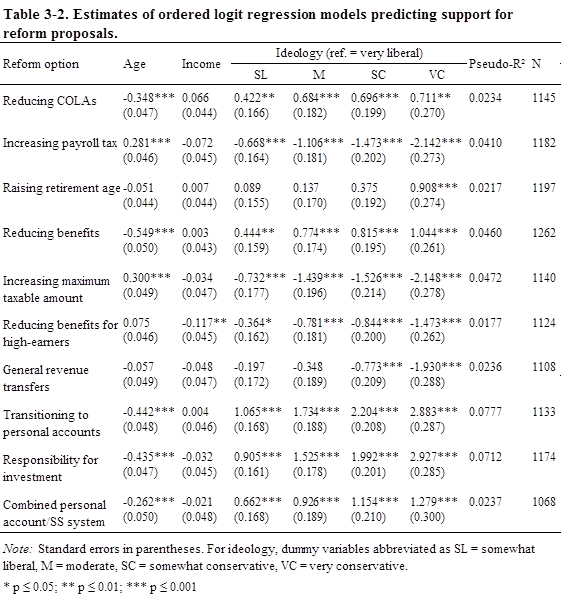

I used statistical analysis to determine how age, income, and ideology (as reported by the respondent) affect individuals’ support for each of the 10 options I discussed. I found that while age and ideology where very strongly correlated to support for specific options, surprisingly, income was not (after controlling for age and ideology). It seems that much of the effect of income is due to ideology. In other words, if a higher-income person is more likely to support privatization than a low-income person, is that due to the income of the respondents, or some other factor? The results showed that ideology is a “confounding variable,” such that when ideology is included in the analysis, all the effect of income disappears. Below are the results of ordered logit regressions of support for each option on the variables age, income, and ideology.

The second part was my original proposal, which used economic rationale, political values and judgments, and the public opinion analysis to devise a series of provisions which would put Social Security back on a sustainable path. My plan includes:

1) Raising the payroll tax by 0.05 percentage points each year for 20 years

2) Increasing the maximum taxable amount such that it covers 90% of all earnings in a given year, phased in over 10 years

3) Progressive price indexing: changing the way benefits are calculated so that benefits rise with price inflation for the highest earners, wage inflation for the lowest 30% of earners, and at some rate in between the two for all others. This would not affect current retirees, as this is used to determine initial benefits.

Partial Privatization:

4) Establish personal retirement accounts (PRAs) by diverting 3% of earnings beginning in 2016. Half is financed by the Social Security Trust Fund, and half is financed by an addition 1.5% contribution.

5) Benefits for those participating in PRAs are reduced gradually until 2058 to offset contributions to the accounts.

Because many groups (the super poor, disabled, widowed) are especially vulnerable to financial losses under a personal account system, I strengthen the social insurance functions of the program so that they are more strongly protected from unfortunate outcomes

6) Establish special minimum benefit equal to 125% of the monthly poverty level.

7) Provide the option of a surviving spouse to receive 75% of the benefit that the married couple would be receiving if both were still alive (currently surviving spouses can receive at most two-thirds of the couples previous benefits)

8) Apply a super-COLA (annual cost-of-living adjustment) to disabled beneficiaries by increasing monthly benefits at a rate that is slightly higher than retired beneficiaries

Together this plan leaves the program with a surplus of 0.42 percent of taxable payroll over 75 years. This surplus exists (1) in the case that interactions between these provisions actually reduces their effect, and (2) in the case that my estimations for a few of the provisions are slightly inaccurate. This plan is a middle-of-the-road approach that contains changes that both Democrats and Republicans, liberals and conservatives, young and old, prefer in a plan to reform Social Security. It takes into account the values embodied in the program over the past 80 years and spreads the costs out fairly across generations. It attempts to minimize the economic consequences by phasing the provisions in over 10 or 20 year periods, while allowing people the opportunity to invest in stocks or bonds that may yield a higher return, but with greater risk, much like the Federal Thrift Savings Plan.

I’ll be back soon with a completely new topic, but I welcome any comments about this plan or anything else related to Social Security and my thesis!

-Anthony